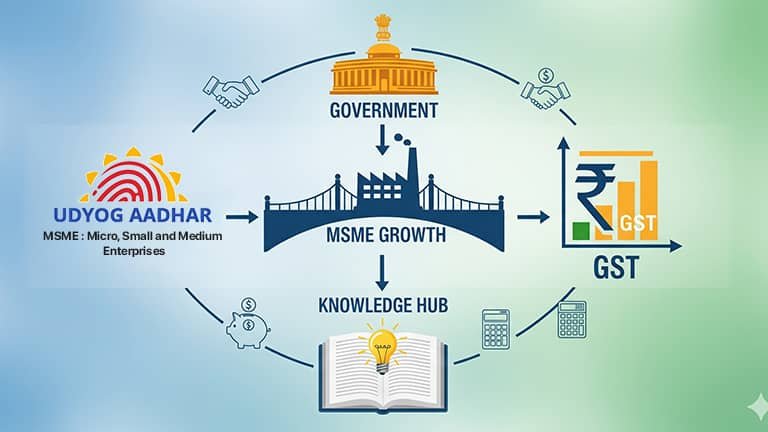

In India, the compliance issue related to the regulations is quite relevant among small and medium business enterprises as it determines the sustainability and growth of these organizations. The two meaningful parts of this compliance are Udyog Aadhaar (It has been migrated into Udyam Registration) and GST (Goods and Services Tax). Both have different functions but they are regularly confused by entrepreneurs. Concerns of GST are widely asked such as whether it is compulsory to be registered for GST under Udyog Aadhaar or what is the difference between GST and Udyog Aadhaar.

This blog will share LS Benchmark MSME registration tips about Udyog Aadhaar, GST, what are their differentiations, and whether GST is mandatory to register under MSME or not, and also how MSME can be registered and registered and avail the maximum benefits.

What will be Udyog Aadhaar?

Udyog Aadhaar was a state venture which started to provide a unique identification number to MSMEs (Micro, Small, and Medium Enterprises). It also made it easier to receive entitlements of many different programs including subsidies, loans, as well as marketing support.

Since July 2020, Udyog Aadhaar is no longer registered under the name Udyam Registration, although most businesses still call it the former name.

Important aspects of Udyog Aadhaar / Udyam Registration

- • Easy sign up

- • Assigns a registration specific Udyam Registration Number (URN)

- • Facilitates access by MSMEs to government incentives and credit programmes

What is GST?

Goods and Services Tax (GST) is an all-purpose tax levied in India in the sale of goods and services. It ousted a multiplicity of indirect taxes and provided uniformity in taxation system.

Who Needs GST Registration?

Registrations of GST are compulsory to:

- • Companies with an annual turnover of 40 lakh (20 lakh and 20 Lakh of the service) or more

- • E-commerce sellers

- • Companies in inter-state/supply

GST Vs Udyog Aadhaar Key differences

Although both GST and Udyog Aadhaar are crucial in the business, they are used to achieve different things.

| Parameter | GST | Udyog Aadhaar (Udyam) |

|---|---|---|

| Purpose | Tax compliance for goods & services | MSME identification & benefits |

| Applicability | Based on turnover & nature of business | Applicable to all MSMEs |

| Registration Authority | GST Department | Ministry of MSME |

| Mandatory? | Yes, if turnover exceeds threshold | Voluntary but highly recommended |

GST is concerned with tax, and Udyog Aadhaar is concerned with business recognition and incentives.

Is it compulsory to enroll under GST Udyog Aadhaar?

No, there is no need of GST to avail Udyog Aadhaar (Udyam Registration). Any one who is either a manufacturer, trader or even a service provider can register as an MSME without GST.

However:

- • In case your turnover is above the GST threshold limit, your business has to be registered under GST.

- • Udyam Registration and GST compliance may be necessary in some of the government tenders or schemes.

Even though perhaps GST is not obligatory to you, still you can register with it to enhance credibility in business and smoothness in conducting business transactions.

Advantages of the Udyog Aadhaar being linked to GST

Although GST is not mandatory in MSME registration, the two go hand in hand as they come with a number of benefits:

- • Unrestricted Access To Credits and Lending - Banks and financial institutions will prefer more businesses which have both the Udyam and GST registration.

- • Government Tenders and Subsidies - Most government contracts use the two registrations to make the company eligible.

- • Tax Compliance / Transparency - GST is a legal compliance strategy that limits risks of penalties.

- • Amplified Credibility to MSMEs - Businesses which are GST-compliant and Udyam-registered are trusted by suppliers and clients.

GST: How to Register MSME?

You should submit the Udyog Aadhaar (Udyam Registration) application form without any difficulty in case you have already paid your own GST.

- • Step 1: Go to the Udyam Registration Portal - Visit www.udyog-aadhar.com

- • Step 2: Put the Aadhaar and PAN details - Enter Aadhaar number of business owners and PAN details.

- • Step 3: Information of business - Enter such information as business name, type, activity and contact information.

- • Step 4: GST Input - Enter GSTIN (in case you have it). It is not compulsory but it fortifies your profile.

- • Step 5: HTTPS and the acquisition of certificate - Once you submit, you will get the Udyam certificate with a unique Udyam Registration Number (URN).

The MSMEs should also possess both registrations

Although GST and Udyog Aadhaar are of different purposes, their combination in possession offers competitive edge. For instance:

- • Legal Compliance - Escape legal fines with GST law.

- • Government Benefits - Avail Subsidies, Preferential loans and Tax breaks under the MSME schemes.

- • Increased growth in business - Impact is felt in terms of easier participation in tenders, trade fairs, as well as export promotion.

Final Thoughts

GST and Udyog Aadhaar are the two foundations of business compliance in India. Although GST vs Udyog Aadhaar shows how they are different, the two tend to complement each other in enhancing the growth of MSMEs. Those who can confuse the next question, the answer is, the GST is not mandatory to file Udyog Aadhaar but these two registrations can guarantee long-term benefits and credibility.